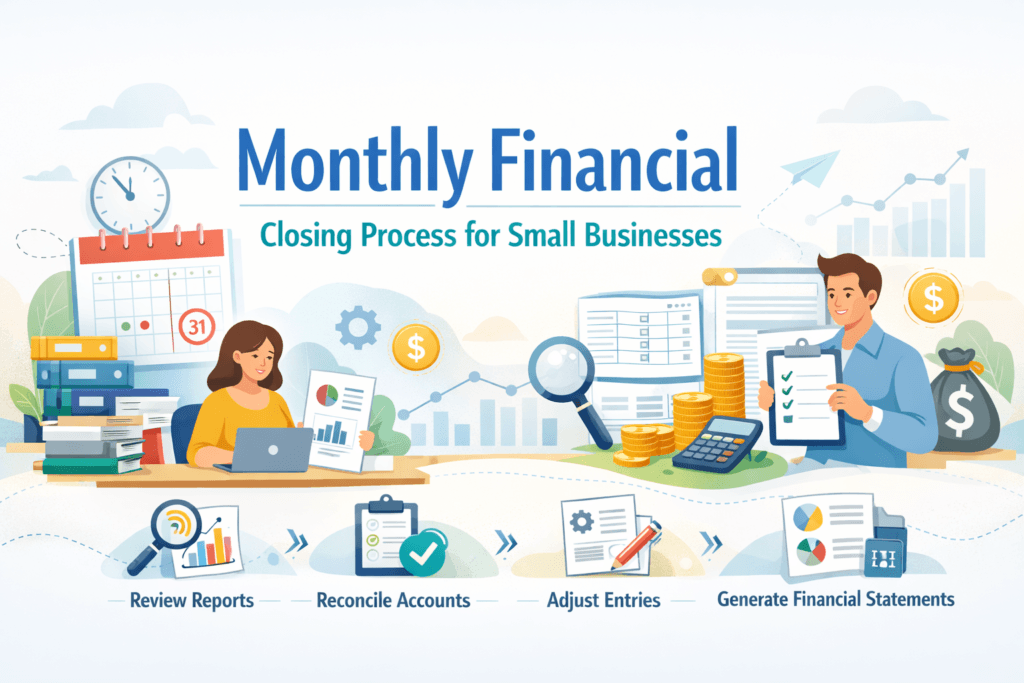

Monthly Financial Closing Process for Small Businesses

The monthly financial closing process for small businesses is the backbone of accurate accounting, tax compliance, and data-driven decision-making. Without a structured month-end close, business owners risk cash flow surprises, compliance issues, and unreliable financial reports.

Whether you’re a startup founder, SME owner, or finance manager, this guide explains how to perform a monthly financial closing process, why it matters, and how to streamline it for growth.

What Is the Monthly Financial Closing Process?

The Invisible Profit Drain in Growing Manufacturing Businesses

The monthly financial closing process is a structured accounting procedure performed at the end of each month to ensure that all financial transactions are recorded, reconciled, and reported accurately.

It involves:

- Recording all income and expenses

- Reconciling bank accounts

- Reviewing accounts payable and receivable

- Adjusting journal entries

- Preparing financial statements

The goal is to produce accurate financial statements, such as:

- Profit & Loss Statement

- Balance Sheet

- Cash Flow Statement

Why Is the Monthly Financial Closing Process Important for Small Businesses?

Small businesses often operate with tight margins. A proper monthly financial closing process helps you:

Maintain Accurate Financial Records

Avoid errors that impact tax filings and investor reporting.

Improve Cash Flow Management

Track outstanding payments and manage liquidity effectively.

Ensure Tax Compliance

Accurate books reduce last-minute tax stress and penalties.

Support Strategic Decision-Making

Reliable financial reports help in budgeting and forecasting.

Detect Fraud or Errors Early

Monthly review helps identify discrepancies before they become major issues.

Step-by-Step Monthly Financial Closing Process

Here’s a structured checklist for a smooth monthly financial closing process:

Record All Financial Transactions

Ensure that:

- All invoices are entered

- Expenses are categorized

- Payroll is recorded

- Sales entries are complete

Use accounting software to automate data entry where possible.

Reconcile Bank and Credit Card Accounts

Compare:

- Bank statements

- Credit card statements

- Internal accounting records

This step ensures your books match actual cash movements.

Review Accounts Receivable (AR)

Check:

- Outstanding invoices

- Late payments

- Customer balances

Follow up on overdue payments to maintain healthy cash flow.

. Review Accounts Payable (AP)

Verify:

- Vendor invoices

- Due dates

- Duplicate payments

Ensure all liabilities are correctly recorded.

Adjust Journal Entries

Make necessary adjustments for:

- Accrued expenses

- Prepaid expenses

- Depreciation

- Inventory adjustments

This ensures accurate reporting under accrual accounting.

Review Payroll and Employee Expenses

Confirm:

- Salaries are processed

- Tax deductions are accurate

- Reimbursements are recorded

Verify Inventory (If Applicable)

For product-based businesses:

- Conduct physical inventory checks

- Adjust stock levels in books

- Record shrinkage or damage

Generate Financial Statements

Prepare:

- Income Statement

- Balance Sheet

- Cash Flow Statement

Review these reports for unusual variances.

. Analyze Financial Performance

Compare:

- Current month vs previous month

- Budget vs actual

- Year-over-year trends

Identify cost-saving opportunities and revenue growth areas.

How Long Should the Monthly Financial Closing Process Take?

Task | Responsible | Frequency |

Record Transactions | Accountant | Monthly |

Bank Reconciliation | Finance Team | Monthly |

Review AR/AP | Accounts Dept | Monthly |

Journal Adjustments | Accountant | Monthly |

Financial Reports | CFO/Owner | Monthly |

Monthly Financial Closing Process Checklist Table

For small businesses:

- Well-structured system → 3–5 business days

- Manual system → 7–10 days

- Automated system → 1–3 days

The more automated your accounting workflow, the faster your month-end close.

Common Challenges in the Monthly Financial Closing Process

- Delayed Data Entry

- Missing Receipts

- Poor Communication Between Departments

- Manual Errors

- Lack of Standardized Checklist

- Implementing SOPs (Standard Operating Procedures) can drastically improve efficiency.

Best Practices to Improve the Monthly Financial Closing Process

- Use Cloud Accounting Software

- Create a Standard Closing Checklist

- Assign Clear Responsibilities

- Automate Reconciliations

- Review Financial KPIs Monthly

Conclusion

A structured monthly financial closing process for small businesses is essential for financial transparency, compliance, and strategic growth. By implementing a clear checklist and leveraging automation tools, businesses can reduce errors, improve efficiency, and gain better control over their financial health.

If you’re a small business owner looking to streamline your accounting workflow, start by standardising your month-end closing process and reviewing your financial statements consistently.

Investing in financial leadership early is one of the smartest decisions a startup can make.

Frequently Asked Questions (FAQs)

What is included in a monthly financial closing process?

The monthly financial closing process includes recording transactions, reconciling accounts, reviewing receivables and payables, making journal adjustments, and preparing financial statements

How can small businesses speed up the monthly financial closing process?

Small businesses can speed up the monthly financial closing process by using accounting software, automating reconciliations, maintaining organized documentation, and following a standardized checklist

Why is bank reconciliation important in the monthly financial closing process?

Bank reconciliation ensures that financial records match actual bank balances, helping detect fraud, accounting errors, and missing transactions.

What are the key reports generated during the monthly financial closing process?

The key reports include the Profit & Loss Statement, Balance Sheet, and Cash Flow Statement.

How often should a small business perform financial closing?

A small business should perform the financial closing process monthly to maintain accurate financial records and support timely decision-making.